15 Normal Costing

- Make the entries required to account for the flow of costs through the accounts in a normal costing system

- Make the entry required to close out the manufacturing overhead account

The Theory

Normal costing is a costing system in which direct manufacturing costs and period costs are recorded in the accounts at their actual amounts, while manufacturing overhead is initially recorded in the accounts at the amount that is allocated to products. Companies that use normal costing instead of actual costing (in which all costs are recorded at their actual amounts) do so because they want the accounts to reflect a timely estimate of costs. An actual costing system is not as timely as a normal costing system because actual manufacturing overhead costs are not known until the end of each period.

In normal costing, actual direct manufacturing costs and applied manufacturing overhead costs flow from work-in-process inventory through finished goods inventory and into cost of goods sold. A manufacturing overhead account tracks how much actual overhead is incurred on the debit side of the account and how much overhead is applied to production on the credit side of the account. At the end of the period, the Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold accounts are adjusted so that they reflect actual rather than applied manufacturing overhead.

In normal costing:

- The cost of materials purchases is added to Raw Materials Inventory.

- When direct materials are put into production, their cost moves from Raw Materials Inventory to Work-in-Process Inventory. When indirect materials are used, their cost moves from Raw Materials Inventory to Manufacturing Overhead, because indirect materials costs are part of actual manufacturing overhead.

- When direct labor works on production, the cost is added to Work-in-Process Inventory.

- When actual manufacturing overhead costs such as utilities, indirect labor, and depreciation on factory equipment are incurred, those costs are added to Manufacturing Overhead.

- When manufacturing overhead is applied to production, the applied cost moves from Manufacturing Overhead to Work-in-Process Inventory.

- If the firm has more than one production department or process, each will have its own Work-in-Process Inventory account. When production is complete in one process, the cost of the goods moves from that process’s Work-in-Process Inventory account to the next department’s Work-in-Process Inventory account.

- When goods are completed:

- The cost of good units moves from Work-in-Process Inventory to Finished Goods Inventory.

- When normal spoilage arises, its cost moves from Work-in-Process Inventory to Manufacturing Overhead.

- The cost of abnormal spoilage can originate in Work-in-Process Inventory (if the spoiled units are incomplete) or Finished Goods Inventory (if the spoiled units are complete). When abnormal spoilage arises, it moves from the applicable inventory account to a Loss account.

- The cost of rework is added to Manufacturing Overhead if it is normal and a loss account if it is abnormal.

- When goods are sold, their cost moves from Finished Goods Inventory to Cost of Goods Sold.

- At the end of the period, the Manufacturing Overhead account balance is closed out to Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold in proportion to their ending balances.

- All period expenses are added to expense accounts.

The Method

Recording Events in a Normal Costing System

To record the events in a normal costing system, make the following journal entries:

| Event | Journal entry | Amount |

|---|---|---|

|

Materials are purchased |

Raw Materials Inventory |

A |

|

Direct materials are put into production |

Work-in-Process Inventory |

B |

|

Indirect materials are put into production |

Manufacturing Overhead |

C |

|

Direct labor works on production |

Work-in-Process Inventory |

D |

|

Manufacturing overhead costs are incurred (other than depreciation) |

Manufacturing Overhead |

E |

|

Depreciation is taken on factory equipment |

Manufacturing Overhead |

F |

|

Manufacturing overhead costs are applied to production |

Work-in-Process Inventory |

G |

|

Goods are transferred from one production department to the next |

Work-in-Process Inventory (Dept. B) |

|

|

Good units are completed |

Finished Goods Inventory |

H |

|

Normal spoilage arises |

Manufacturing Overhead |

I |

|

Abnormal spoilage arises |

Loss from Abnormal Spoilage |

J |

|

Normal rework costs are incurred |

Manufacturing Overhead |

K |

|

Abnormal rework costs are incurred |

Loss from Abnormal Rework |

L |

|

Goods are sold |

Cost of Goods Sold |

M |

|

Period expenses are incurred (other than depreciation |

Period Expense account |

N |

|

Depreciation is taken on office equipment |

Period Expense account |

O |

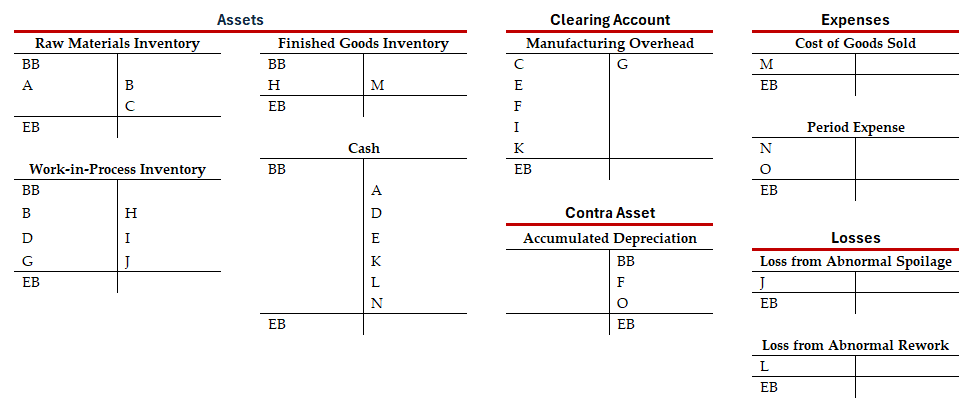

And/or record the amounts in t-accounts (BB = Beginning Balance, EB = Ending Balance, A–O refer to amounts from journal entries above):

The Work-in-Process Inventory account includes B, D, G, and I on the debit side, and H and J on the credit side. In the Finished Goods Inventory account, H and M appear on the credit side, while B is posted to the debit side. The Cash account shows BB (beginning balance), A, D, E, K, and L on the credit side, and N on the debit side. In the Manufacturing Overhead clearing account, C, E, F, I, and K are posted on the debit side, while G appears on the credit side. The Cost of Goods Sold account shows M on the debit side. The Period Expense account includes N and O on the debit side. The Loss from Abnormal Spoilage account includes J on the debit side, and the Loss from Abnormal Rework account includes L on the debit side. Finally, Accumulated Depreciation, a contra-asset account, contains BB, F, and O on the credit side.

Closing Out Manufacturing Overhead

Finally, make the entry to close out the manufacturing overhead account. Start by calculating the amount of overapplied or underapplied manufacturing overhead:

- Find the balance in the Manufacturing Overhead account before adjustment

- If the account has a debit balance, overhead is underapplied

- If the account has a credit balance, overhead is overapplied

Then add the balances in Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold before adjustment, and divide each balance by the total to determine what percentage of overapplied or underapplied overhead will go to each account.

- Multiply the percentage by the total amount of overapplied or underapplied manufacturing overhead to calculate the adjustment amounts for each account.

|

Description |

Ending Balance |

Modifier |

Total |

Modifier |

MOH Balance |

Modifier |

Adjustment |

|---|---|---|---|---|---|---|---|

|

Work-in-Process |

A |

÷ |

D |

× |

E |

= |

F |

|

Finished Goods |

B |

÷ |

D |

× |

E |

= |

G |

|

Cost of Goods Sold |

C |

÷ |

D |

× |

E |

= |

H |

|

Total |

D |

|

|

|

|

|

D |

Make the appropriate journal entry, depending on whether the overhead is overapplied or underapplied. Another way of thinking about it is that if Manufacturing Overhead has a credit balance (overapplied), it needs to be debited to zero out the account, and if Manufacturing Overhead has a debit balance (underapplied), it needs to be credited to zero out the account. Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold will go on the other side of the entry to balance it.

- If manufacturing overhead is overapplied:

- Manufacturing Overhead

- Work-in-Process Inventory

- Finished Goods Inventory

- Cost of Goods Sold

- Manufacturing Overhead

- If manufacturing overhead is underapplied:

- Work-in-Process Inventory

- Finished Goods Inventory

- Cost of Goods Sold

- Manufacturing Overhead

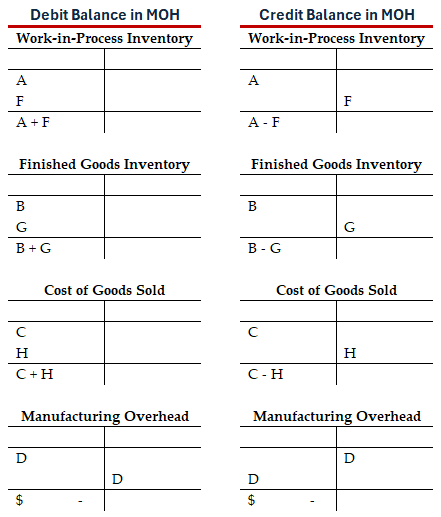

And/or record the amounts in t-accounts.

Long image description:

The left column shows how to record a debit balance (underapplied overhead), while the right column shows the journal entries for a credit balance (overapplied overhead), using letters to refer to transactions from the table above. In the debit balance column, the Work-in-Process Inventory account has entries A and F on the debit side. The Finished Goods Inventory account includes B and G on the debit side. The Cost of Goods Sold account shows C and H on the debit side. The Manufacturing Overhead account has D on the credit side and a zero balance after closing. In the credit balance column, the Work-in-Process Inventory account has A on the debit side and F on the credit side. The Finished Goods Inventory account has B on the debit side and G on the credit side. The Cost of Goods Sold account has C on the debit side and H on the credit side. The Manufacturing Overhead account includes D on the debit side, which clears the balance to zero.

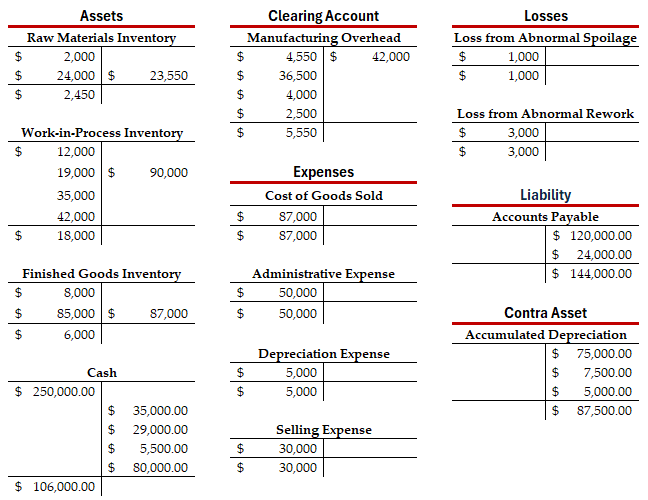

Illustrative Example

Mergler Company uses job costing and applies overhead to jobs at a rate of 120% of direct labor costs. Beginning inventories were $2,000 in Raw Materials Inventory, $12,000 in Work-in-Process Inventory, $8,000 in Finished Goods Inventory, $250,000 in Cash, $120,000 in Accounts Payable, and 75,000 in Accumulated Depreciation. Mergler experienced the following last period:

- Purchased 10,000 pounds of direct materials at $2 per pound and $4,000 in indirect materials on account.

- Used 9,500 pounds of direct materials and $4,550 in indirect materials.

- Paid direct labor $35,000 in cash.

- Incurred $10,000 for factory rent, $7,000 for indirect labor, and $12,000 in miscellaneous manufacturing overhead, all paid in cash, and recorded $7,500 in factory equipment depreciation.

- Transferred goods costing $90,000 out of work-in-process inventory, $4,000 of which was spoilage normal for the production process, and $1,000 of which was abnormal spoilage.

- Incurred normal rework costs of $2,500 and abnormal rework costs of $3,000, paid in cash.

- Sold goods costing $87,000.

- Incurred administrative expenses of $50,000 and selling expenses of $30,000, both paid in cash, and recorded $5,000 in office equipment depreciation.

Record all costs last period in a journal entry or t-account.

- Raw Materials Inventory: $24,000

- Accounts Payable: $24,000

- To record materials purchased

- Work-in-Process Inventory: $19,000

- Manufacturing Overhead: 4,550

-

- Raw materials Inventory: $23,550

- To record materials used ($19,000 = 9,500 x $2)

- Work-in-Process Inventory: $35,000

- Cash: $35,000

- To record direct labor costs incurred

- Work-in–Process Inventory: $42,000

- Manufacturing Overhead: $42,000

- To record manufacturing overhead applied ($35,000 x 120%)

- Manufacturing Overhead: $36,500

- Cash: $29,000

- Accumulated Depreciation: 7,500

- To record actual manufacturing overhead costs incurred

- Finished Goods Inventory: $85,000

- Manufacturing Overhead: 4,000

- Loss from Abnormal Spoilage: 1,000

- Work-in-Process Inventory: $90,000

- To record the costs of completed goods

- Manufacturing Overhead: $2,500

- Loss from Abnormal Rework: 3,000

- Cash: $5,500

- To record rework costs incurred

- Cost of goods sold: $87,000

- Finished goods: $87,000

- To record the cost of goods sold

- Administrative expense: $50,000

- Selling expense: 30,000

- Depreciation expense: 5,000

- Cash: $80,000

- Accumulated depreciation: 5,000

- To record period costs incurred

Long description for image:

In the Raw Materials Inventory account, the beginning balance is $2,000 on the debit side. Additional debits of $24,000 are posted, and a credit of $23,550 reflects raw materials issued. The ending balance is $2,450 on the debit side. The Work-in-Process Inventory account has a beginning balance of $12,000. Debits of $19,000, $35,000, and $22,000 are posted, and a credit of $90,000 reflects the transfer to finished goods. The ending debit balance is $18,000. In the Finished Goods Inventory account, the beginning balance is $8,000. Debits of $85,000 are posted, and a credit of $87,000 reflects the transfer to cost of goods sold. The ending balance is $6,000 on the debit side. The Cash account begins with a $250,000 debit balance. It is credited for $35,000, $29,000, $5,000, and $80,000 in various payments, and debited for $5,500. The ending balance is $106,000. In the Manufacturing Overhead clearing account, the debit side includes $4,550, $36,500, $4,000, $2,500, and $5,550. A credit of $42,000 reflects applied overhead. The Cost of Goods Sold account is debited for $87,000, representing goods sold. The Administrative Expense account is debited for $50,000, the Depreciation Expense account is debited for $5,000, and the Selling Expense account is debited for $30,000. Two Loss accounts are shown: Loss from Abnormal Spoilage includes a $1,000 debit and $1,000 credit; Loss from Abnormal Rework includes a $3,000 debit and $3,000 credit. The Accounts Payable liability account shows credits of $120,000 and $24,000 and a debit of $144,000, resulting in a zero balance. Finally, the Accumulated Depreciation contra-asset account has a beginning credit balance of $75,000 and additional credits of $7,500 and $5,000, for an ending credit balance of $87,500.

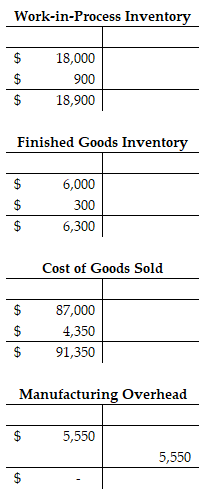

To close out manufacturing overhead:

- The manufacturing overhead account has a debit balance of $5,550, so manufacturing overhead is underapplied by $5,550.

- Prorate the underapplied overhead according to ending balances before adjustment:

|

Description |

Ending Balance |

Modifier |

Total |

Modifier |

MOH Balance |

Modifier |

Adjustment |

|---|---|---|---|---|---|---|---|

|

Work-in-Process |

18,000 | ÷ | 111,000 | × | 5,500 | = | 900 |

|

Finished Goods |

6,000 | ÷ | 111,000 | × | 5,500 | = | 300 |

|

Cost of Goods Sold |

87,000 | ÷ | 111,000 | × | 5,500 | = | 4,350 |

|

Total |

111,000 |

|

|

|

|

|

5,500 |

- Work-in-process inventory: $900

- Finished goods inventory: 300

- Cost of goods sold: 4,350

- Manufacturing overhead: $5,550

- To record the entry to close manufacturing overhead

Long description for image:

In the Work-in-Process Inventory account, the debit side includes $18,000 and the credit side includes $900, resulting in an ending debit balance of $17,100. In the Finished Goods Inventory account, the debit side includes $6,000 and the credit side includes $300, resulting in a final debit balance of $5,700. In the Cost of Goods Sold account, debits of $87,000 and $4,350 are posted, resulting in a total debit of $91,350. In the Manufacturing Overhead account, a debit of $5,550 is posted on the left side, and a credit of $5,550 is posted on the right side to close the account, resulting in a zero balance.

Muldrow Corporation uses job costing and applies manufacturing overhead costs to jobs at a rate of $15 per direct labor hour. Beginning balances were $100,000 in Raw Materials Inventory, $250,000 in Work in Process Inventory, and $400,000 in Finished Goods Inventory. This period, the following transactions occurred:

- Direct materials worth $500,000 and indirect materials worth $120,000 were purchased on account.

- Direct materials worth $575,000 and indirect materials worth $130,000 were put into production.

- Direct labor was paid $450,000 cash for 45,000 hours of work.

- Actual manufacturing overhead costs other than indirect materials were $620,000, $605,000 of which was paid in cash, and $15,000 of which was for depreciation.

- Goods units costing $1,450,000 and units costing $30,000 that were spoiled as a normal part of the production process were transferred out of work-in-process inventory.

- The company incurred normal rework costs of $10,000 and abnormal rework costs of $15,000, paid in cash.

- The company incurred $800,000 in period expenses paid in cash and $200,000 in office equipment depreciation.

- The company sold goods costing $1,305,000.

Record the following in a journal entry or t-account:

- The purchase of materials.

- The use of materials.

- The payment of direct labor costs.

- The application of manufacturing overhead.

- The incurrence of actual manufacturing overhead.

- The completion of goods.

- The incurrence of rework costs.

- The sale of goods.

- The incurrence of period expenses.

- The entry to close the manufacturing overhead account.

Lecture Examples

Your firm has engaged in the following transactions. Make the appropriate journal entry, then post the entry to the corresponding t-accounts. Beginning balances are already entered in the t-accounts.

- Purchased materials on account for $300,000, including 14,200 pounds of direct materials and $16,000 in indirect materials.

- Used 12,000 pounds of direct materials worth $240,000.

- Used indirect materials worth $15,000.

- Paid $500,000 cash for 25,000 hours of direct labor.

- Paid $400,000 cash for variable manufacturing overhead and $200,000 cash for fixed manufacturing overhead, and recognized $100,000 in factory equipment depreciation.

- Applied manufacturing overhead to jobs at a rate of $25 per direct labor hour.

- Completed goods costing $1,000,000 to manufacture.

- Accounted for normal spoilage costing $20,000.

- Accounted for abnormal spoilage costing $15,000.

- Paid $50,000 cash for normal rework.

- Paid $30,000 cash for abnormal rework.

- Sold goods costing $750,000.

- Closed the Manufacturing Overhead account.

- Paid period expenses of $550,000 in cash and took $50,000 in office equipment depreciation.

A costing system in which direct manufacturing costs and period costs are recorded in the accounts at their actual amounts, while manufacturing overhead is initially recorded in the accounts at the amount that is allocated to products

A costing system in which all costs are recorded at their actual amounts