6 The Operating Budget

- Prepare budgets for revenue, production, direct materials, direct labor, manufacturing overhead, ending finished goods inventory, and cost of goods sold

- Calculate a predetermined manufacturing overhead rate

- Calculate the components of a budgeted operating income statement

The Theory

Firms prepare budgets for several reasons: to plan for production needs, to set motivational goals, to provide a benchmark for evaluating actual results, to facilitate communication across departments and divisions, and many others.

The operating budget is a component of the master budget, which is essentially a set of budgeted financial statements. The operating budget is a budgeted income statement from revenue through operating income. It consists of several subsidiary budgets:

- The revenue budget: How much sales revenue the firm plans to earn, measured in dollars

- The production budget: How many units the firm plans to produce, measured in output units

- The direct materials usage budget: How much direct materials the firm plans to use in production, measured in units of direct materials such as pounds or gallons as well as dollars, and prepared separately for each type of material used in production

- The direct labor budget: How much direct labor the firm plans to use in production, measured in hours and dollars

- The manufacturing overhead budget: How much the firm plans to spend on manufacturing overhead, measured in dollars, and the predetermined overhead rate, measured as a rate per unit of cost allocation base, or if the cost allocation base is a dollar amount, as a percentage of the cost allocation base

- The ending finished goods inventory budget: The value of ending finished goods inventory, measured in dollars

- The cost of goods sold budget: The cost of the goods the company plans to sell, measured in dollars

- The period expense budget: The amount of nonmanufacturing costs the company plans to incur, measured in dollars

- The budgeted income statement: A summary of the other budgets

The operating budget for a manufacturing company reflects the costing system used to assign costs to manufactured goods for the purpose of valuing inventories and cost of goods sold. Recall that in a manufacturing company, all the costs of manufacturing goods are attached to products. Therefore, the three categories of manufacturing costs—direct materials, direct labor, and manufacturing overhead—are what make up the budgets for ending finished goods inventory and cost of goods sold.

Because manufacturing overhead is not traceable, it must be allocated or applied to products using a predetermined overhead rate. A firm chooses a cost allocation base that they believe varies with the overhead they assign to products, and calculates a rate based on that cost allocation base. The company then uses this rate throughout the year to apply manufacturing overhead costs to products.

The Method

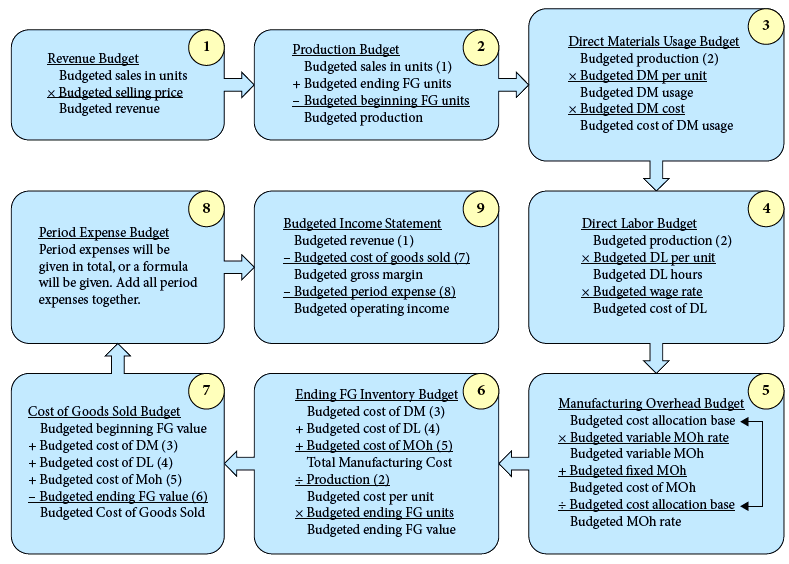

A company prepares nine budgets as part of the master budgeting process. They are presented below, numbered in the order in which they should be prepared. Numbers in parentheses indicate an item that appeared on a previous budget.

- Revenue budget: Budgeted sales in units multiplied by budgeted selling price equals budgeted revenue.

- Production budget: Budgeted sales in units (from step 1) plus budgeted ending finished goods units minus budgeted beginning finished goods units equals budgeted production.

- Direct materials usage budget: Budgeted production (from step 2) multiplied by budgeted direct materials per unit equals budgeted direct materials usage. Budgeted direct materials usage multiplied by budgeted direct materials cost equals the budgeted cost of direct materials usage.

- Direct labor budget: Budgeted production (from step 2) multiplied by budgeted direct labor per unit equals budgeted direct labor hours. Budgeted direct labor hours multiplied by budgeted wage rate equals budgeted cost of direct labor.

- Manufacturing overhead budget: Budgeted cost allocation base multiplied by budgeted variable overhead rate equals budgeted variable overhead. Budgeted variable overhead plus budgeted fixed overhead equals total budgeted manufacturing overhead. Total budgeted manufacturing overhead divided by budgeted cost allocation base equals the budgeted manufacturing overhead rate.

- Ending finished goods inventory budget: Budgeted cost of direct materials (from step 3) plus budgeted cost of direct labor (from step 4) plus budgeted cost of manufacturing overhead (from step 5) equals total manufacturing cost. Total manufacturing cost divided by production (from step 2) equals budgeted cost per unit. Budgeted cost per unit multiplied by budgeted ending finished goods units equals budgeted ending finished goods inventory value.

- Cost of goods sold budget: Budgeted beginning finished goods inventory value plus budgeted cost of direct materials (from step 3) plus budgeted cost of direct labor (from step 4) plus budgeted cost of manufacturing overhead (from step 5) equals total manufacturing costs. Total manufacturing costs minus budgeted ending finished goods inventory value (from step 6) equals budgeted cost of goods sold.

- Period expense budget: Period expenses are either given in total or determined using a formula. All period expenses are added together to get the total period expense.

- Budgeted income statement: Budgeted revenue (from step 1) minus budgeted cost of goods sold (from step 7) equals budgeted gross margin. Budgeted gross margin minus budgeted period expense (from step 8) equals budgeted operating income.

Illustrative Example

Muschup Corporation produces wooden rocking horses. In the upcoming year, the sales department estimates the firm will be able to fill demand for their product, which should be 10,000 units. The firm tries to keep an inventory of 500 finished horses on hand at all times, but at the end of this year, inventory has dropped to 200 horses, valued at $35,000.

Each unit sells for $200 and uses 20 board-feet of wood that costs $2.50 per board-foot and a quart of paint that costs $20 per quart.

Each horse requires 3.2 hours of direct labor, paid at $20 per hour. Muschup estimates that variable overhead costs $5 per direct labor hour. Fixed overhead is estimated at $247,200, and selling, general, and administrative costs are estimated at $100,000.

| Budgeted sales in units | 10,000 |

|---|---|

| Budgeted selling price | × $200 |

| Budgeted revenue | 2,000,000 |

| Budgeted sales in units | 10,000 |

|---|---|

| Budgeted ending FG units | + 500 |

| Budgeted beginning FG units | − 200 |

| Budgeted production units | 10,300 |

| Budgeted production units | 10,300 |

|---|---|

| Budgeted DM per unit | × 20 board-feet |

| Budgeted DM usage | 206,000 board-feet |

| Budgeted DM cost | × $2.50 |

| Budgeted cost of DM usage | 515,000 |

| Budgeted production units | 10,300 |

|---|---|

| Budgeted DM per unit | × 1 quart |

| Budgeted DM usage | 10,300 quarts |

| Budgeted DM cost | × $20 |

| Budgeted cost of DM usage | 206,000 |

| Budgeted production units | 10,300 |

|---|---|

| Budgeted DL hours per unit | × 3.2 hours |

| Budgeted DL hours | 32,960 hours |

| Budgeted wage rate | × $20 |

| Budgeted cost of DL | 659,200 |

| Budgeted cost allocation base | 32,960 direct labor hours |

|---|---|

| Budgeted variable MOh rate | × $5 per DL hour |

| Budgeted variable MOh | 164,800 |

| Budgeted fixed MOh | + 247,200 |

| Budgeted total MOh | 412,000 |

| Budgeted cost allocation base | ÷ 32,960 direct labor hours |

| Budgeted MOh rate | 12.50 per DL hour |

| Budgeted cost of wood usage | 515,000 |

|---|---|

| Budgeted cost of paint usage | 206,000 |

| Budgeted cost of DL | 659,200 |

| Budgeted MOh | 412,000 |

| Total manufacturing cost | 1,792,200 |

| Production units | ÷ 10,300 |

| Budgeted cost per unit | 174 |

| Budgeted ending FG units | × 500 |

| Budgeted ending FG value | 87,000 |

| Budgeted beginning FG value | 35,000 |

|---|---|

| Budgeted cost of DM usage | + 721,000 |

| Budgeted cost of DL | + 659,000 |

| Budgeted cost of MOh | + 412,000 |

| Budgeted ending FG value | − 87,000 |

| Budgeted cost of goods sold | 1,740,200 |

| Budgeted SG&A expenses | 100,000 |

|---|

| Budgeted revenue | 2,000,000 |

|---|---|

| Budgeted cost of goods sold | − 1,740,200 |

| Budgeted gross margin | 259,800 |

| Budgeted period expense | − 100,000 |

| Budgeted operating income | 159,800 |

Redique, Inc., which manufactures sports drinks, is preparing their budget for next quarter. Redique plans to sell 400,000 bottles next quarter and 500,000 the quarter after next, at a price of $1.25 per bottle. Each bottle requires 12 fluid ounces of drink ingredients, which costs $2.56 per gallon (there are 128 fluid ounces in a gallon), and a bottle, which Redique purchases pre-manufactured for $0.30 per bottle. Variable manufacturing overhead costs are expected to be $7.50 per direct labor hour, and fixed manufacturing overhead costs are expected to be $51,250 for the quarter. Direct labor is paid $15 per hour; on average, 20 workers are on the assembly line at a time, and bottles are produced at a rate of 1,000 per hour. Redique estimates that variable selling expenses will total $0.05 per unit sold, and that other operating expenses (all fixed) will total $25,000.

Redique’s policy is to carry an ending finished goods inventory equal to 10% of the following quarter’s projected unit sales. Based on information from the current quarter, however, Redique expects to begin next quarter with finished goods inventory of 40,000 bottles worth $42,600.

Prepare budgets for revenue, production, direct materials, direct labor, manufacturing overhead, ending finished goods inventory, cost of goods sold, period expense, and income.

Lecture Example

Your business manufactures sofas, and charges $2,000 per unit. You are expecting to sell 20,000 units this month, 30,000 next month, and 25,000 the following month. Each unit requires 40 board-feet of wood, 10 yards of padding, and 20 yards of upholstery material. Wood costs $6 per board-foot, padding costs $30 per yard, and upholstery material costs $25 per yard. Each sofa requires 12 labor hours to assemble at a cost of $10 per hour. Variable manufacturing overhead is estimated at 150% of direct labor costs. Fixed manufacturing overhead is $4,800,000 per month. Selling costs are 10% of revenues, and general and administrative costs are $2,100,000 per month. Ending finished goods inventories are 10% of the following month’s sales. Beginning finished goods inventory will be valued at the current cost of $1,500 per sofa.

- Prepare a revenue budget for this month.

- Prepare a production budget for this month and next month.

- Prepare a direct materials budget for this month.

- Prepare a direct labor budget for this month.

- Prepare a manufacturing overhead budget for this month.

- Prepare an ending finished goods inventory budget for this month.

- Prepare a cost of goods sold budget for this month.

- Prepare a period expense budget for this month.

- Prepare a budgeted income statement for this month.

Predictions of financial results for future periods

A budgeted income statement from revenue through operating income

A set of budgeted financial statements

A statement reporting revenues and expenses for a particular period

A budget for how much revenue the firm plans to earn, measured in dollars

A budget for how many units the firm plans to produce, measured in output units

A budget for how much direct materials the firm plans to use in production, measured in units of direct materials and dollars

A budget for how much direct labor the firm plans to use in production, measured in hours and dollars

A budget for how much the firm plans to spend on manufacturing overhead, measured in dollars, and for the predetermined overhead rate the firm plans to use

The rate at which manufacturing overhead is applied to products, expressed as a rate per unit of cost allocation base

A budget for the value of ending finished goods inventory, reflecting the product costs that went into manufacturing the goods in ending finished goods inventory, measured in dollars

A budget for the cost of goods the company plans to sell, measured in dollars

A budget for the nonmanufacturing costs the company plans to incur, measured in dollars

An income statement consisting of predicted revenues and expenses for a particular period, rather than actual revenues and expenses

Able to be traced to a cost object

Assigned to a cost object; used when a cost is indirect (cannot be traced)