10 New Product Concept Market and Grocery Store Research

Once you have a new product concept, dig into the market and grocery store research further. Some trend articles include market research such as how big a market is in terms of sales or who is the target audience of a trend. Use all of the information that is available. Do additional research as needed to answer the questions on the Market and Grocery Research worksheet.

It can be difficult to think about all aspects of market research, so it is helpful to break it down into segments. As research is done, the goal is to hone in and improve your new product concept.

Here are components to consider:

- How big is the market segment most closely related to your new product concept?

- Sometimes multiple market segments need to be considered if a new product concept could fit into multiple categories.

- Find any and all data available in terms of market size, growth, saturation, and trends.

- It is likely not possible to find all of this information, but the more information gathered, the better of a case you can build for the new product.

- Or you may need to modify your new product concept if a relevant market segment is saturated with little room for growth.

- How does your new product concept compete with similar current products?

- You will not have all of the product details at this point but should be able to come up with advantages for your new product over competitor products.

- Why would a consumer buy your product over other similar products? If there is not a good answer to this question, it will be important to rethink your new product concept.

- Who is your target audience, and why?

- Very few products are marketed to everyone. It is important to know your target audience. This will help you to determine what attributes of your product are most important (nutrient content, flavor, price, convenience, etc.).

- Not sure who your target audience is? Go back to trend articles. Typically one to two consumer groups are driving each trend.

- The target audience will also shape the sales of your product. Are you developing a niche product for a small target audience? If so, more profit per unit may be necessary.

- If you are developing a product for a large target audience (such as all moms or all millennials), then your marketing and product characteristics are going to need to appeal to a larger audience. This may look like more recognizable flavors or ingredients.

- Where will your product be found in the grocery store?

- Does that location make sense if consumers are trying to find your product?

- How easy or difficult will it be for your new product to stand out in that part of the grocery store?

- Does the location match your product characteristics? You may want to put a coffee beverage in the coffee aisle, but your product may be more convenient to consume (or have an improved shelf life) if it is sold in the refrigerated section.

Not sure how to answer these questions? Here are some references that will help.

Market Segment Information

Typically an internet search is a good place to start. Look for food business articles that include market data. It may take a bit of time to find what you are looking for, but it is worth being diligent.

Grocery Store Sales

To start:

- Think about the number of players or brands in a segment

- Consider how much of the segment is made up of private-label products

- For example, private label is a large component of cereal, not in candy (candy is heavily branded)

- Some segments have multiple private label brands/quality levels (think Target’s multiple private labels as an example)

- There are better margins on private labels – no money is spent on advertising – the private label segment is growing currently.

To help in determining sales volumes and segment size, the below reference was created by experts in the grocery sales field in 2020. Use these indicators to evaluate the potential for a new food product.

| Market Segment/Product Category | Size of Segment/ Sales Volume | Average Mark-Up Including Promotion | Product Turnover |

| Cereal | 5 | 3 | 5 |

| Chip/Snack | 5 | 3 | 5 |

| Cookie/Crackers | 3 | 3 | 3 |

| Granola Bars/Mixes | 3 | 3 | 2 |

| Candy | 4 | 3 | 3 |

| Prepackaged Baked Goods | 1 | 3 | 2 |

| RTE Desserts/Puddings | 2 | 3 | 1 |

| Bakery Dry Mix | 3 | 3 | 4 |

| Fruit Snacks | 1 | 3 | 2 |

| Peanut Butter & Jelly | 3 | 3 | 3 |

| Salsas/Pickles/Dips | 3 | 4 | 2 |

| Sauces/Dressings/Condiments | 4 | 3 | 2 |

| Soups – Canned & Dry Mix | 3 | 2 | 4 |

| Pasta, Boxed Dinners | 3 | 4 | 3 |

| Refrigerated Sides & Salads | 3 | 3 | 3 |

| Frozen Appetizers & Entrees | 4 | 4 | 3 |

| Frozen Breakfast | 2 | 3 | 2 |

| Yogurt | 4 | 3 | 5 |

| Ice Cream | 5 | 2 | 5 |

| Processed Meats/Deli Meats | 4 | 3 | 5 |

| Fresh Meats | 5 | 2 | 5 |

| Poultry | 3 | 3 | 4 |

| Fish | 2 | 3 | 3 |

| Tea/Coffee | 5 | 3 | 4 |

| Soda | 5 | Not able to provide | 5 |

| Juice | 3 | 3 | 3 |

| Waters | 5 | 3 | 5 |

| International Cuisine | 2 | 4 | 1 |

| Gluten-Free Prepared Foods | 1 | 3 | 1 |

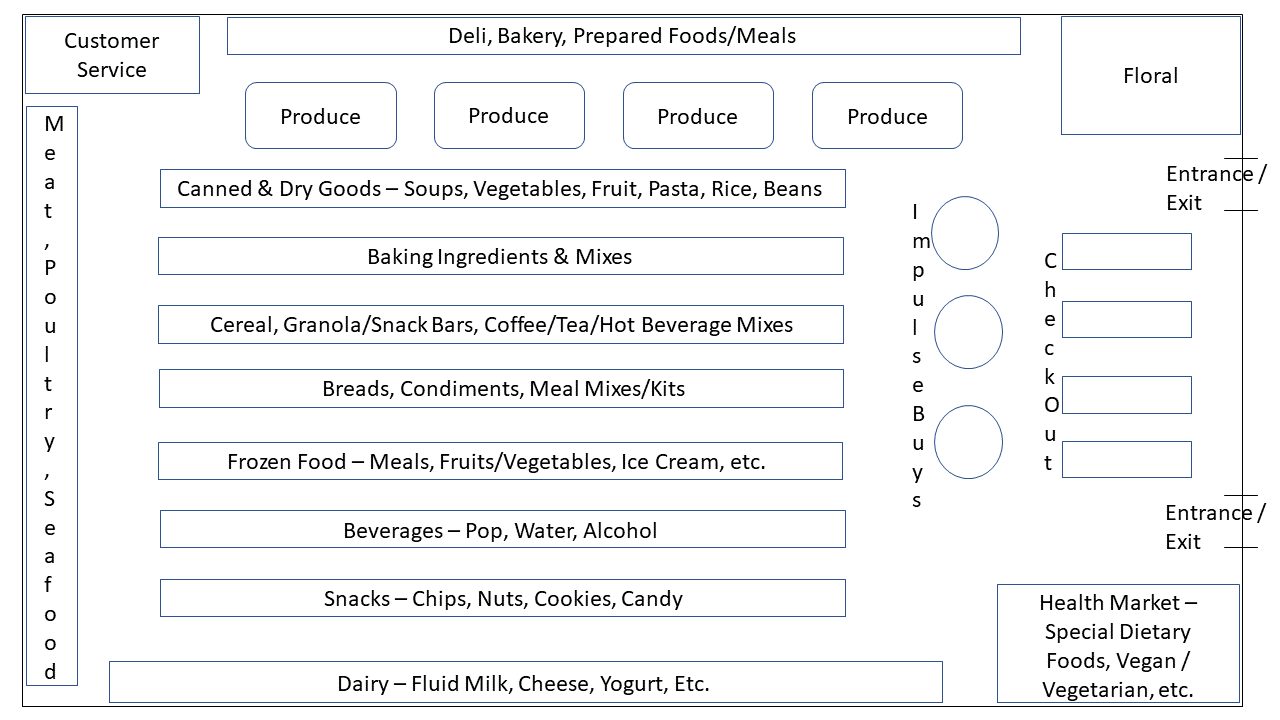

Grocery Store Layout

All grocery stores are laid out a little differently, but it is good to think about the general layouts of grocery stores and where your new product would fit in the store.

Here is an article (from the consumer perspective) on how items are placed in the grocery store. It also is encouraged to visit local grocery stores. Often in-person research will be more valuable than online research. If possible, visit 2 to 3 grocery stores or stores with a large grocery section. Typically, visiting at least one mainstream/large grocery store and one specialty grocery store is recommended to provide multiple perspectives and show the breadth of products and categories.